Simplifying your financial decisions

In the UTUA, you can read exclusive guides and articles on financial planning, products and much more!

Financial education for everyone

Learn everything you need to know about finance, credit cards, loans and financial management here!

Credit Card

Loan

Why trust UTUA?

We are a free platform that offers financial education content and tools to help people achieve their financial goals. We make money by showing ads on our content, which does not affect the quality of what we offer. Our priority will always be to provide truthful and useful information to our users.

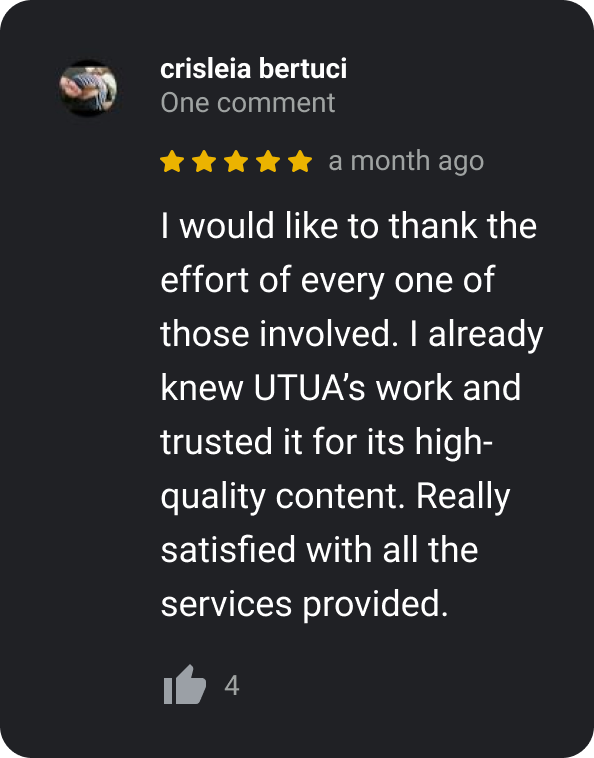

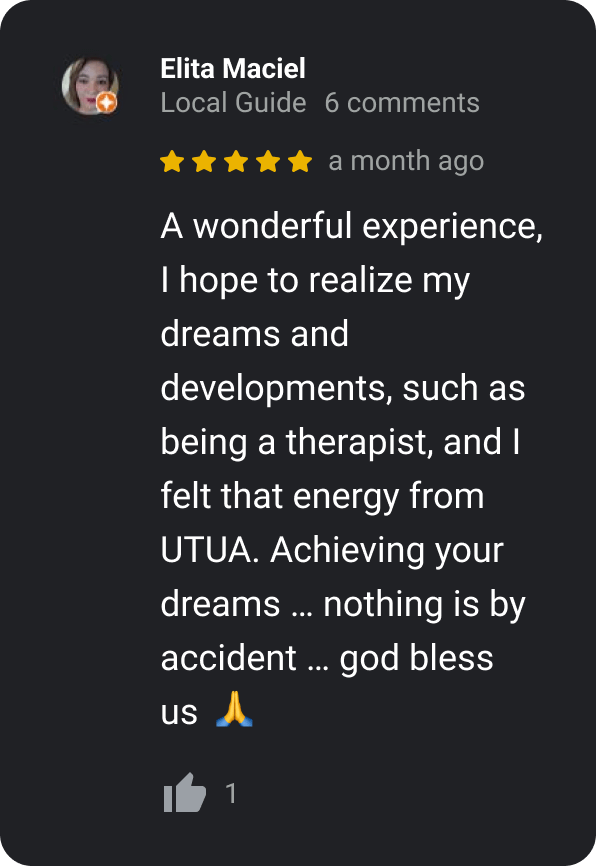

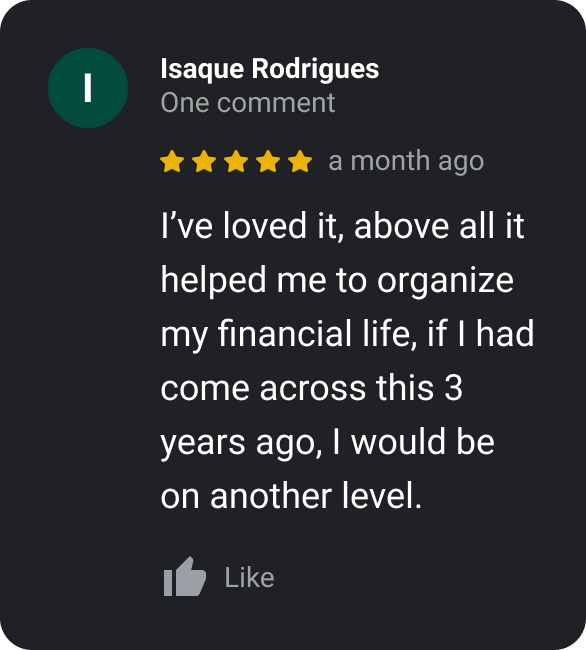

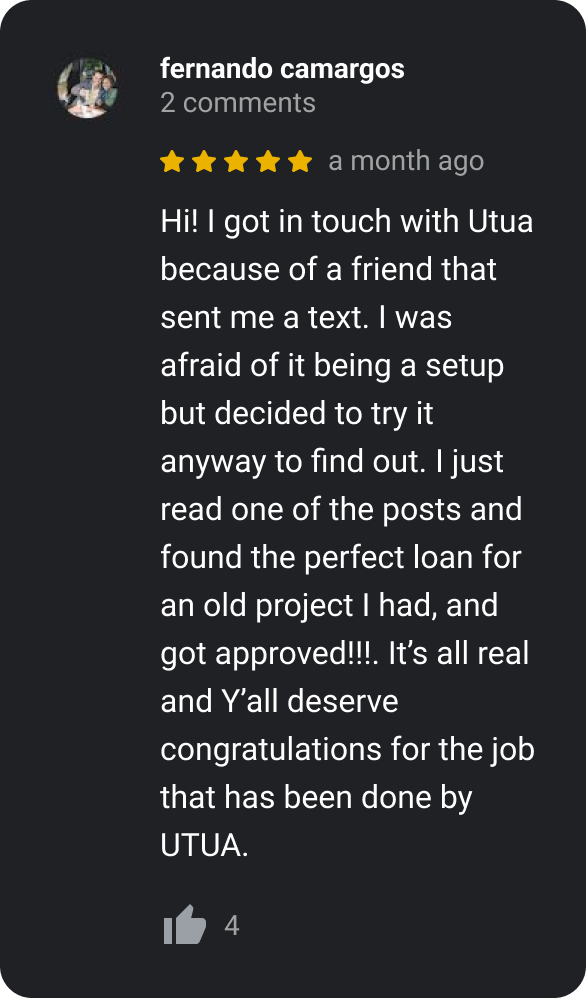

See the results of our members

Check out testimonials from Utua members and see how they are achieving financial success!

Frequently Asked Questions

Need help? See some questions we frequently receive.

No, UTUA is not a bank and therefore we do not provide credit cards or loans, nor are we responsible for reviewing and approving them. We are a news blog with content and analysis of financial products. We have complete content with reviews of various cards, so you can get detailed information on which product suits you best. In addition to the thousands of information you can find on our blog, our team sends daily emails with the best exclusive content according to your profile.

UTUA is not a scam but a news blog with content and analysis of financial products. We were created because we believe that you shouldn’t have to pay to have access to the best information in the financial world. Today, we are a community of over 20 million people seeking quality information. UTUA’s main objective is to help people by recommending financial products that best fit their profile. You will receive our emails with indications of financial products when you answer the questionnaire. UTUA only indicates the best products according to your profile, and there is no connection between us and financial institutions. When our readers choose a product based on our reviews and recommendations, we direct them to the official website of the financial institution, where the application will be made. From there, we have no further involvement, as it is an exclusive environment between the bank and the potential new client. All UTUA content and product indications are provided for free. If you receive a charge in the name of UTUA, please ignore it, as we do not send it. Our goal is to make your financial life easier and better, without charging anything for it. You can be completely confident that we not only want to help you, but we will help you!

UTUA only indicates the best products according to your profile, and there is no connection between UTUA and the financial institution. When our readers choose a product based on our reviews and recommendations, we direct them to the official website of the financial institution, where the application will be made. From there, we have no further involvement, as it is an exclusive environment between the bank and the potential new client. However, if you have any doubts about the content we send you, please call us on one of the service channels so that we can help you!

Emails sent by us only contain indications of products, which you may or may not request directly from the responsible financial institution. All UTUA content and product indications are provided free of charge. So please be assured that emails from UTUA are not about bills or charges. UTUA is not responsible for the approvals, releases or even the sending of cards, this is the sole responsibility of the financial institutions, and you can follow your requests in the communication channels of the card issuing company. Clear around? If your answer was no, just call us on one of our service channels so we can help you!

We care about correct information! All our content is written using the official websites and blogs of the institutions responsible for each financial product as the main source. We take great care to offer the best content, in a transparent way, so you can have a better financial life! But if you have questions about the content we send you, call us on one of the service channels so we can help you!

Haven’t received a response yet?

Contact us! Our team of experts will be happy to assist you.